Already reeling from inflation and a US-led geopolitical scenario that leaves little room for optimism, D2C brands have raised alarms, mist forming on shippers’ foreheads as surcharges continue to climb.

Residential surcharges have seen a bump of approximately 6.6%, while delivery area surcharges have been pushed upward by as much as 7.1% in some regions. From large-package surcharges to additional handling fees and the introduction of cubic-volume thresholds, everything is set to impact the bottom line for brands that rely heavily on shipping.

Shipping analytics exists to aid them. This quiet weapon helps uncover cracks in operational flow, identify where costs are quietly increasing, and show brands where money is leaking through the system. This guide will show how brands can use a shipping analytics platform to fight rising carrier fees in 2026 and regain control where it matters most.

Why Carrier Fees Are Rising in Canada (2026)

While it was expected that carrier fees would rise in Canada in 2026, that does not mean it isn’t hurting brands. Add-ons are multiplying, giving leading players like Canada Post, UPS, and FedEx the ability to stack layered surcharges almost exclusively..

Fuel is an interesting factor because prices have continued to soften across the Great White North. But due to delayed adjustments and surcharges being tied to diesel indices, carriers like Canada Post, UPS, and FedEx keep this fuel-related add-on floating longer than expected.

Another factor pushing carrier fees higher in 2026 is the stricter dimensional rule, which does not always account for weight fairly. . The impact of this rule funnels into other surcharges, especially when size triggers specialized handling.

Extended service charges also contribute to inflated carrier fees, as the cost per pound increases when parcels are shipped to remote regions of Canada.

Cross-border shippers are also facing surprise charges. A user named nervoustrainee wrote on /PersonalFinanceCanada that they were hit with a special assessment charge for a ring purchased for their partner. The issue was that the “special charge” was not mentioned anywhere during checkout.

Free-shipping thresholds have gone up, dimming customer satisfaction, reducing order volume, and compounding the damage to profit margins.

Thankfully, shipping analytics remains the secret weapon that can salvage this situation.

What Is Shipping Analytics?

In simple terms, shipping analytics is the process of collecting and analyzing all data related to shipping, then leveraging that data to gain insights that improve efficiency, cut costs, and increase customer satisfaction. It treats shipping as a combination of multiple measurable parts that can be observed, compared, and optimized.

The process can be vast, especially when there are multiple data points to monitor. However, the key data most users track includes shipping costs, delivery times, carrier performance, order and destination data, and customer impact signals.

Shipping analytics is especially important for small brands, as shipping alone can consume 15-30% of an order’s value, particularly when the average order value is low. With shipping data analytics, D2C brands can set realistic free-shipping thresholds, identify underperforming regions, choose the right carrier, reduce surprise fees, and set realistic delivery speed expectations.

How Shipping Analytics Helps You Fight Rising Fees?

Here are the ways shipping analytics helps brands uncover rising fees:

1. Identify Hidden Fees

If fees were based only on base rates, nothing would be hidden. But when fuel surcharges, peak season surcharges, and residential delivery fees Canada enter the picture, brands have to stay alert to multiple data points at once.

Canada Post’s recent mismatch between fuel surcharges shown at checkout and those listed elsewhere is a clear example. Residential delivery fees can also be higher than expected, and often not by mistake. Peak season surcharges tend to spike as traffic congestion, bad weather, and seasonal volume pressures quietly push costs upward. With shipping analytics, brands can pinpoint where these surges are coming from and understand why they are happening.

Here is one example that clearly showcases the impact hidden fees often have on carrier charges:

| Cost Component | Description | Amount (CAD) |

| Base Transportation Rate | Standard ground shipping (Zone 5, 2–3 business days) | $12.50 |

| Fuel Surcharge (18%) | Applied as % of base rate | $2.25 |

| Residential Delivery Fee | Delivery to a non-commercial address | $4.85 |

| Extended Area Surcharge | Semi-rural / remote postal code | $3.50 |

| Dimensional Weight Adjustment | Package billed at dimensional weight vs actual | $2.90 |

| Peak / Demand Surcharge | Seasonal or capacity-based fee | $1.75 |

| Address Correction Fee | Minor formatting or validation issue | $6.00 |

| GST / HST | Tax applied to shipping services | $1.98 |

| Total Shipping Cost | Final invoiced amount | $35.73 |

The table presents a rather pessimistic view of the charges, but it reflects reality. When the total cost reaches $35, the base rate accounts for only around 35% of the final charge. For brands that don’t focus on carrier invoice analysis, the additional $23 from layered surcharges remains hidden, making shipping invoices feel unpredictable and hard to trust.

2. Spot Carrier Performance Issues

Carriers may be delivering late or delivering only near the 11th hour. However, if customers aren’t complaining, their inefficiencies go unnoticed. Therefore, instead of relying on customer feedback, taking the “shipping analytics” approach allows brands to keep tabs on late deliveries, transit delays, exception rates by carrier, service levels, and regions.

Together, the gathered data can reveal a pattern indicating whether a carrier is underperforming in a specific region. Brands can use this data as evidence to negotiate a better deal during contract reviews: new penalty clauses can be added to service-level agreements. For instance, there could be a clause for refunds on missed deliveries or reduced fees in regions where the carrier has consistently underperformed.

3. Optimize Shipping Zones

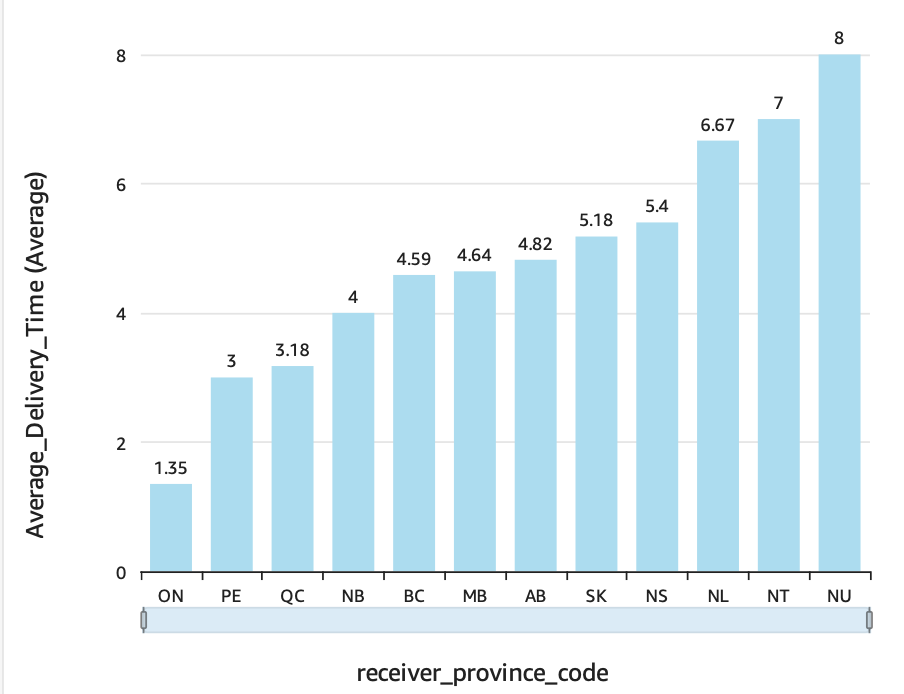

Zone-based shipping charges cause significant pain for brands, with carrier fees for even light parcels doubling in some regions. Remote areas like Saskatchewan or Nunavut, for instance, can push fees to a level that could annihilate profit margins altogether.

By pooling data from shipping analytics, brands can implement zone-skipping strategies, moving bulk orders closer to their final destination before last-mile delivery.

Data from shipping analytics can also be leveraged to make smarter warehousing decisions, such as storing inventory in regions not subject to zone-based charges. The goal here is to route and store shipments through cheaper zones, reduce exposure to repeated zone-based rate hikes, and stabilize costs over time.

4. Uncover Cost-Saving Opportunities

Thanks to the information provided through shipping analytics, users can adopt the cheapest shipping method based on weight, zone, or size. A deeper analysis of the data may reveal that one carrier performs better with light packages, offering reliable service at lower cost, while another helps keep expenses down by efficiently handling heavier shipments. This is where multi-carrier analytics Canada begins to matter, allowing brands to match each shipment to the carrier that makes the most sense.

Another advantage is mode optimization, which shows brands how different transit modes perform across distances. For example, ground transit may be a suitable, less costly option for certain products up to a specific distance, while the cost per unit weight may drop when air transport is used for the remaining stretch.

5. Benchmark Carrier Rates

Shipping analytics can also help brands keep tabs on different carrier rates. The focus of the analysis is not just on the numbers, but on where those numbers come from. Benchmarking base rates, surcharges, and performance using real data enables brands to secure better terms when they sit across from carriers at the negotiation table. Over time, this visibility feeds directly into broader shipping cost reduction strategies.

With all data out in the open, there are fewer hidden details that can derail cost restructuring discussions. Brands with stronger data positions carry more leverage because they understand exactly where carriers fall short or exceed expectations. Keeping multiple carriers in view also gives brands quite a leverage, signaling that a carrier unwilling to adjust can be replaced by a viable alternative.

When to Switch Carriers Based on Analytics?

It is one thing to have access to shipping analytics for e-commerce in Canada, and another to decode them and leverage the data to decide whether to continue with a carrier or switch. Below are red flags that analytics-driven data can surface, along with the questions brands should ask before making a final call.

Surcharges Are Rising Faster than the Base Rate

If brands notice that fuel surcharges, residential surcharges, or special assessment charges are rising quarter over quarter while base rates increase only annually, it is time to pause and ask hard questions.

- Which surcharges are floating and which are fixed contractually?

- How is the fuel surcharge calculated?

- Is there a maximum threshold on surcharges?

If the surcharges are float-rated, the lag period for fuel surcharge adjustments is high, and no maximum threshold is mentioned in the official service agreement, brands should switch carriers.

On-Time Delivery is Low Consistently

The service-level agreement explicitly mentions the percentage of deliveries that should be on time. While brands can forgive one or two infractions, if shipping performance analytics show the on-time delivery rate stays below the SLA consistently, it is time to ask hard questions:

- How have the two parties defined “on-time” in the agreement?

- If a delivery is late, are refunds processed automatically or manually?

- Which shipping routes are causing repeated delays?

These questions can form the basis of future negotiations and adjustments in SLAs. For instance, if deliveries are routed through remote areas, “on-time” may need a revised definition. Shipping routes can also be re-adjusted for future deliveries. However, these adjustments depend on the carrier’s flexibility. If that flexibility is lacking, brands should switch carriers.

Average Cost of Shipment is Rising for Products of the Same Weight

Shipping analytics may reveal that the average cost of shipping is increasing even when the deliverable’s dimensions remain the same. This issue brings forth the following questions:

- Have dimensional and pricing rules changed since the last contract review? If so, what are the new prices?

- Is there an update to billing and weight-rounding policies?

- Are details explaining fee variation based on weight available?

Carrier transparency becomes the deciding factor in these cases. It is up to carriers to communicate every rule change clearly, and the SLA should leave room for negotiation if brands cannot readily accept those changes. If that transparency is missing, switching carriers becomes the more practical option.

Don’t Just Track. Act on the Data

Shipping analytics offers a lot of information, but gaining information is only half the task. Once data tracking is complete, brands must act on it.

If a carrier is not delivering well in specific zones, shifting the shipping route is optimal. If residential surcharges are too high, altering checkout costs is desirable. From renegotiating fees to changing service levels to updating rules, these are all actions that must be taken to actually use shipping analytics to fight rising carrier charges. And that requires creating a proper recurring review workflow.

Ready to Fight Carrier Fees? Start With Your Data

Carrier fees in Canada are no longer rising quietly. Fuel surcharges, residential fees, and zone-based increases are compounding quarter after quarter, making intuition-driven shipping decisions expensive. The advantage now lies in visibility. Shipping analytics turns raw invoice data into leverage, highlighting hidden charges, performance gaps, and cost-saving opportunities that directly impact margins.

ShippingChimp helps Canadian brands centralize carrier data, uncover inefficiencies, and act before costs spiral further. A focused analytics review can reveal where fees are leaking and which decisions need immediate correction.

Check out ShippingChimp’s shipping rate analyser.

The shipping rate analyser helps you find hidden fees, surcharges, zone skipping charges on your current invoice. More over it offers you recommendations on optimizing your shipping costs.

FAQ Section

What are the main carrier fees that affect Canadian eCommerce brands?

The biggest cost drivers go far beyond base shipping rates. Canadian eCommerce brands are most affected by fuel surcharges, residential delivery fees, extended or remote area surcharges, dimensional weight charges, and peak or demand-based fees. Fuel surcharges fluctuate regularly and apply as a percentage on top of base rates. Residential and extended-area fees are fixed add-ons that hit most D2C shipments. Dimensional weight penalties often increase costs when packaging is inefficient. Together, these fees can represent more than half of the final shipping invoice, especially for brands shipping nationwide.

What’s the difference between shipping analytics and shipping software?

Shipping software helps execute shipments. It creates labels, selects carriers, and tracks parcels. Shipping analytics explains what happened after the shipment moved. Analytics focuses on cost trends, delivery performance, surcharge exposure, and profitability by region or order type. Software answers how to ship an order. Analytics answers whether that shipment made financial sense.

Can I use shipping analytics without switching carriers?

Yes. Shipping analytics is carrier-agnostic. It works with existing carriers and contracts by analyzing invoice and performance data. In fact, many brands use analytics first to identify problems before even considering a switch. Analytics may reveal that only certain zones or services are underperforming, allowing targeted fixes rather than a full carrier change.

Which KPIs should I track to lower shipping costs?

Focus on a small set of actionable KPIs. Cost per shipment shows overall efficiency. Surcharges as a percentage of total cost reveal hidden fee exposure. On-time delivery rate highlights performance issues that lead to refunds and churn. Billing adjustment rate identifies invoice accuracy problems. Cost by zone or region shows where distance-based pricing hurts margins. Tracking these consistently helps brands reduce shipping costs without sacrificing customer experience.

- How to Use Shipping Analytics to Fight Rising Carrier Fees in Canada 2026 - January 28, 2026

- Deconstructing the 2026 GRI: How FedEx & UPS Rate Hikes Impact Canadian Shippers - January 19, 2026

- Canada Post vs. Canpar vs. Purolator: The Remote Area Delivery Battle in 2026 - January 19, 2026